Investment Management

This essay will assess and perform a critical analysis with respect to the efficient market hypothesis and the theory associated with behavioural finance. In addition to this, this will further evaluate whether stock prices are determined on the basis of these theories or not.

The stock market is an essential part of the capital market, without which Hall, Foxon, and Bolton (2017) showed, economic development is impossible. Against this background, the exchange, being known to be just a secondary market, nevertheless:

- acts as the most important macroeconomic institution for the redistribution of financial resources,

- is an instrument for determining the actual value of technology corporations whose assets are connected with the stock market;

- the values of its indices are considered as one of the key indicators of the economic situation as a whole.

Since the exchange is only a place that provides the opportunity for trade transactions between sellers and buyers of securities, the question arises: is the result of such transactions effective in terms of the mechanism of functioning of the capital market? It will be effective if, as a result of transactions, a fair price is set for the relevant financial assets, under which corporate shares most often act (Hall, Foxon, and Bolton, 2017). In other words, if the stock price set during the exchange trading is correct, then the stock market functions efficiently.

In domestic literature, an effective market is understood in some cases as an ideal market, and in others as an institutional structure with zero transaction costs, equal access to information and equal benefits for all participants (Lo, 2017). There are various trends in the real market, but in general, the tendency to increase the ego of efficiency is constantly making its way through opposing trends. In principle, oscillatory movements are impossible in an ideal market and in its ideal institutional environment. In this regard, an effective market is the antipode of a cyclical market. The efficient market hypothesis built its evidence base on the random walk hypothesis. Paul Samuelson in the mid-1960s published evidence that if the market is efficient, then the price movement is random. Lo (2017) developed this idea in his doctoral dissertation and brought it to the hypothesis of an effective market.

According to the hypothesis of an effective market, the normal state of the market is effective. In this regard, the market is balanced and does not require any external influences – adjustments (Tuyon and Ahmad, 2016). An inefficient market indicates a crisis and requires external adjustments. For half a century of existence, the efficient market hypothesis has become one of the most influential concepts in modern economics and the cornerstone of financial theory. The hypothesis has become the theoretical basis for measuring an effective and inefficient market, but has not provided criteria to evaluate market performance levels. Market efficiency is presented as a state (axiomatic approach). Special tests of market efficiency/inefficiency have been developed (Tuyon and Ahmad, 2016). Based on the hypothesis of an effective market, various models have been created:

• A model of rational expectations, on the basis of which a series of correlations of price changes are carried out, informing about the level of market efficiency taking into account risk;

• A model based on the Pearl Harbour effect (the attack on the US Navy by Japan was preceded by the strange behaviour of the Japanese military). Search for unusual transactions and unusual behaviour of market agents allows you to highlight the first signs of change. Special models capture changes and allow certain conclusions to be drawn;

• Tests “outside the trading rules” and systematic “randomness” expanded understanding of the behaviour of financial markets. However, they did not play any role in the development of trading practice.

If the efficient market hypothesis assumes a perfectly even, non-cyclical development of the market, then the proponents of the theory of behavioural finance take the opposite position with respect to the effective market hypothesis (Ţiţan, 2015). When analysing the real estate market, Schiller came to the conclusion that a bubble has formed in the mortgage lending market, which indicates the inevitability of a change in the phase of the cycle from growth to crisis.

For an effective market, two dimensions are important - time and space, within which the exchange and all actions take place (Ţiţan, 2015). Trust controls the efficiency of the market, and in its absence, the market itself is impossible. Each market agent is well aware that psychology greatly influences decision-making in financial markets. Excessive gullibility, herd behaviour and following the leader, hope, fear and various emotions can explain some market anomalies, for example, an increase in the frequency of purchases on certain dates (Ţiţan, 2015). Dozens of such anomalies are documented, for example, the effect of calendar investments: many investors make the purchase and sale of assets on the same dates and in the same scenario. Market abnormalities usually increase the level of risk.

|

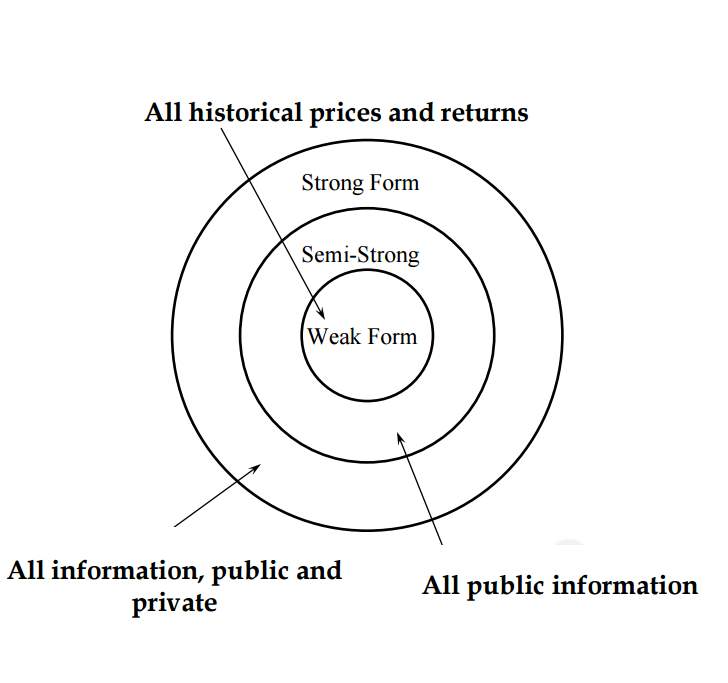

The rationality of economic agents is the foundation of neoclassical economics and finance (Jakub, 2015). However, in the past few decades, disciplines such as behavioural economics, behavioural finance and neuroeconomics, which aim at finding phenomena the irrational behaviour of individuals and their explanation. Many studies by psychologists and economists showed that decision-making by consumers, manufacturers, investors, managers and other agents are subject to significant distortion (Jakub, 2015). However, proponents of the theory of economic agents maximizing utility based on all available information, consider that the efficient market hypothesis reflects the most important characteristics of the market, and on average individuals are rational. There are three forms of market efficiency: weak, medium and strong. According to the weak form of the hypothesis in market prices reflects all publicly available historical information about quotes (Jakub, 2015). According to the average form, all publicly available information about quotes and the performance of the issuing company. A strong form of hypothesis implies that the value of securities reflects all possible information, including internal insider (Jakub, 2015). Even proponents of the efficient markets’ hypothesis find a strong form impossible to real life.

The efficient market hypothesis is based on the following points:

- the presence of many market participants;

- individuals collect and process market information, analyse it until the valuation

- market participants will not approximately coincide with the observed market price;

- prices reflect information available to market participants, which means limited opportunity

- make a profit above the normal level on an ongoing basis;

- securities with a higher degree of risk, on average, have a higher yield;

- stock returns cannot be predicted, that is, it is subject to “random walk”

Nardo, Petracco‐Giudici, and Naltsidis (2016) argued that stock market prices were changing randomly and were impossible to predict. However, they began to study this topic in more detail in the second half of the 20th century. The most significant works on the subject of the efficient markets’ hypothesis are the book “Random wandering around Wall Street "in 1973 B. In these works, scientists argue that the individual cannot receive a higher return permanent market average and the return on securities is best described by random wandering around.

|

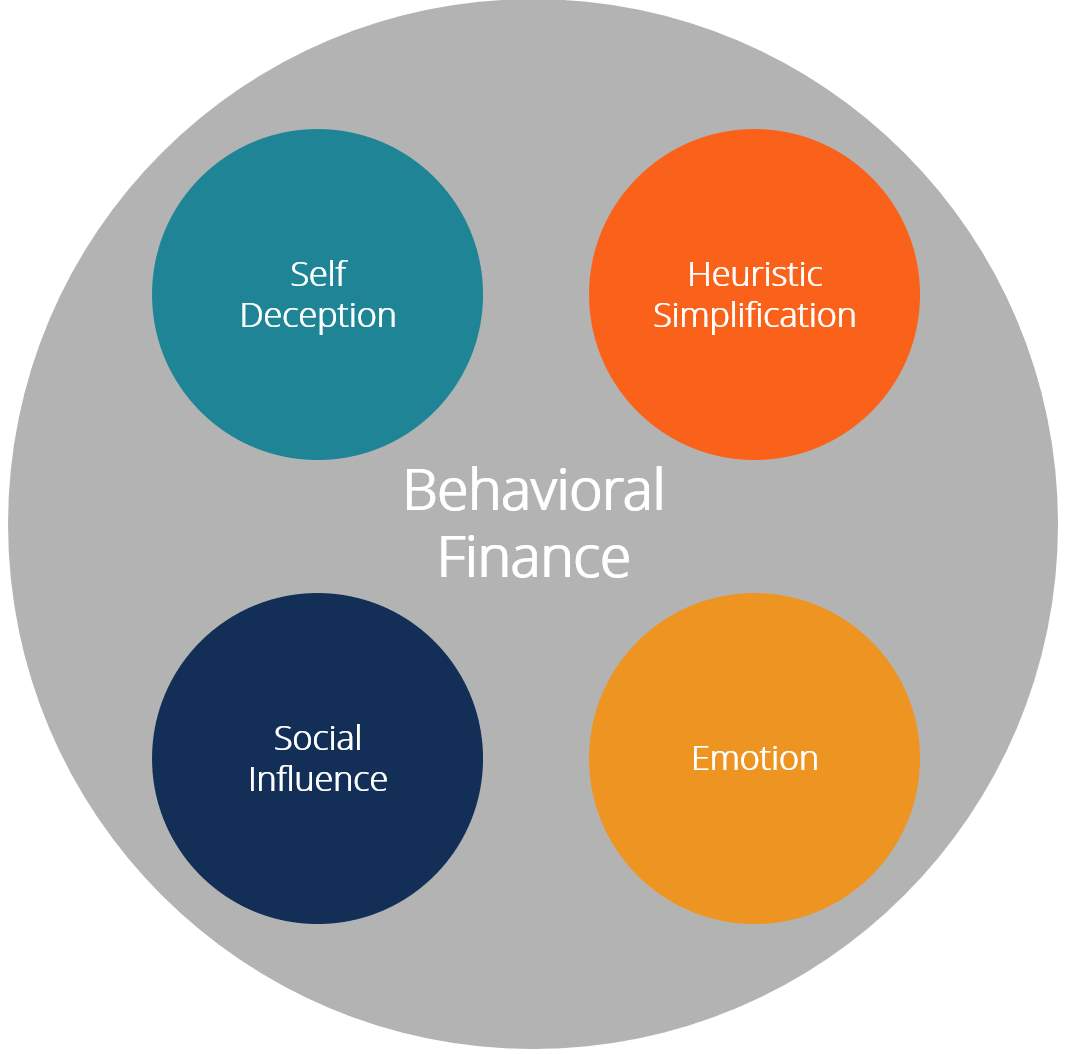

The opposite point of view is held by economists and financiers of behavioural directions. The theory of behavioural finance combines finance, psychology and sociology. This discipline gained wide popularity after the Nobel Prize in Economics (Hamid, Suleman, Ali Shah, Akash, and Shahid, 2017). A little earlier, in 1999, these professors of finance The Massachusetts Institute of Technology and the University of Pennsylvania have written the book “Non-random Wandering on Wall Street, "where they disproved the hypothesis of efficient markets. The theory of behavioural finance is based on the following premises:

- Investors exhibit excessive or inadequate response as a result of distortion in processing information.

- The mistakes of individual investors correlate with each other, and therefore they do not compensate for each other.

- Limited arbitrage opportunities which refers to having rational investors is not enough to make the market efficient

Over the past 50 years, the hypothesis of efficient markets has been tested a lot of research. The Wall Street Journal conducted an experiment in 1988. It concluded comparing the results of professional investors and randomly choosing stocks to invest newspaper staff (Ramiah, Xu, and Moosa, 2015). Out of 100 times, professional investors won the 61st competition. However, only 51 times out of 100 professional investors were able to surpass the passive strategy investing in the Dow Jones index. Studies carried out by various scientists’ hypotheses of effective markets on real data have shown conflicting results. Most a common result was the fulfilment of the hypothesis for developed countries and the failure to fulfil development.

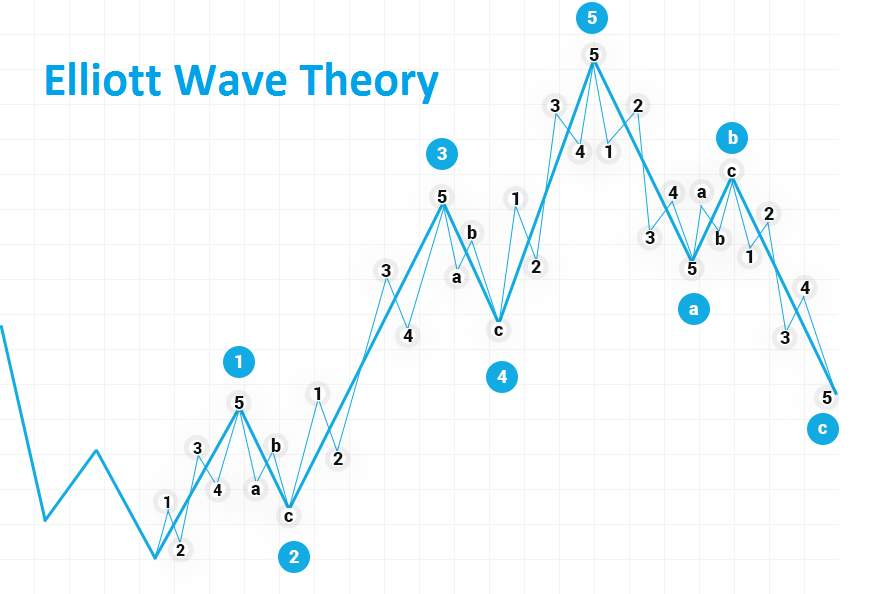

As an example of the complete opposite of this theory, one can point to the well-known and widely applied theory of Elliott waves (Thaler, 2016). According to this theory, periodic trends arise in stock markets that can be represented as a certain combination of impulse and correction (directed against the trend) waves. These are two mutually exclusive concepts that simulate the behaviour of prices in stock markets. Martingales, in the theory of Elliott waves corresponds to lateral correction, i.e. movement in which prices fluctuate in a certain corridor around its average value (Thaler, 2016). This is also called as trend waves in the martingale model is explained by random walk, and the trend itself as a result of a randomly formed serial correlation.

|

When individuals make decisions, the following types of cognitive distortion arise:

- Heuristics - the presence of mental programs that simplify decision-making, but do not take into account many significant factors (Thaler, 2016). There are two main types of heuristics:

- Availability heuristic - revaluation of the probability of those events that are easier to remember or imagine.

- Representation heuristic - a judgment on the probability of an event based on stereotypes. An example of a representativeness heuristic is investor revaluation of continuation current trends in the future. Investors often buy assets that are popular in the given time and avoid securities that have recently shown poor results. That's an example representativeness heuristic that cause speculative bubbles on stock markets.

- Excessive confidence - reassessing your ability to achieve any result. Evidence of investor overconfidence was cited by scientist Thaler (2016) in his study where he interviewed 300 professional managers of investment funds and found that almost 100% of them consider that they make a profit at an average level and above average.

- Conservatism - an underestimation of the changes taking place due to confidence in the soon return to normal the state of affairs (Ito, Noda, and Wada, 2016). However, if the changes last long enough, individuals are rebuilt and act inconsistent with the heuristic of representativeness, overestimating the duration of trends.

- The desire to avoid loss - a negative reaction to losses is much more than positive to profit. This phenomenon explains the fact that individuals are more likely to take risks in order to avoid losses, not to increase profits (Ito, Noda, and Wada, 2016). Striving to Avoid Losses Underpins Strategy motivation through the imposition of fines, which is often more effective than the motivation of any either a reward.

When it is said that the hypothesis of an effective market implies the equality of market and “right” prices, another, more serious and strong content is invested in this (Ito, Noda, and Wada, 2016). No matter what investments the company intends - in the development of new products, production processes, etc. - market participants are always able to assess the value of these investments, wondering what effect they will have on the nearest quotes of this company, as well as assess the most likely income from the primary placement of shares. Capital markets will provide funds for those investments that have the highest market value (Ito, Noda, and Wada, 2016). If other markets do not experience serious falls, then the hypothesis of an effective market states that the selected investments will be most useful from the point of view of society.

References

- Hall, S., Foxon, T.J. and Bolton, R., 2017. Investing in low-carbon transitions: energy finance as an adaptive market. Climate policy, 17(3), pp.280-298.

- Hamid, K., Suleman, M.T., Ali Shah, S.Z., Akash, I. and Shahid, R., 2017. Testing the weak form of efficient market hypothesis: Empirical evidence from Asia-Pacific markets. Available at SSRN 2912908.

- Ito, M., Noda, A. and Wada, T., 2016. The evolution of stock market efficiency in the US: A non-Bayesian time-varying model approach. Applied Economics, 48(7), pp.621-635.

- Jakub, B., 2015. Does Bitcoin follow the hypothesis of efficient market?. International Journal of Economic Sciences, 4(2), pp.10-23.

- Lo, A.W., 2017. Efficient markets hypothesis. The New Palgrave Dictionary of Economics, pp.1-17.

- Nardo, M., Petracco‐Giudici, M. and Naltsidis, M., 2016. Walking down wall street with a tablet: A survey of stock market predictions using the web. Journal of Economic Surveys, 30(2), pp.356-369.

- Ramiah, V., Xu, X. and Moosa, I.A., 2015. Neoclassical finance, behavioral finance and noise traders: A review and assessment of the literature. International Review of Financial Analysis, 41, pp.89-100.

- Thaler, R.H., 2016. Behavioral economics: Past, present, and future. American Economic Review, 106(7), pp.1577-1600.

- Ţiţan, A.G., 2015. The efficient market hypothesis: Review of specialized literature and empirical research. Procedia Economics and Finance, 32, pp.442-449.

- Tuyon, J. and Ahmad, Z., 2016. Behavioural finance perspectives on Malaysian stock market efficiency. Borsa Istanbul Review, 16(1), pp.43-61.