Retirement Planning and Recommendations

It is very important to consider Ana’s needs beyond investment advice to ensure that she achieves her financial goals. There are many products related to retirement and providing for Ana’s dependent (her one-year old son) to consider. Since Ana has a long-time horizon to her retirement date, and after graduate school we can assume Ana begins working and earning income, she can consider investing some of her funds into a defined contribution plan. She could also consider investing in an Individual Retirement Account, either Roth or Traditional. Another option is to consider saving for unexpected health care costs in the future by utilizing a Health savings account. In addition to these accounts Ana could consider an annuity later in life to provide the guaranteed income she is concerned about. In terms of providing for her dependents, Ana should purchase some insurance. A life insurance policy, such as a term life policy can be implemented to ensure that her dependents are provided for if something were to happen to Ana. A disability insurance policy is another vehicle Ana could consider in order to protect her and her dependents should something happen to her. Later in life Ana should look into a Long-term Care policy to help her manage the costs of nursing home care, home health care, etc. should something happen to her.

Accounts such as a 401(k) or 403(b) are a good option for Ana to take advantage of, provided her employer offers this type of benefit. A defined contribution plan such as a 401(k) could allow Ana to save for retirement in an account that is tax advantaged. Making contributions to a 401(k) will help Ana to save for retirement and if properly invested supplement the diversification of her other investments. Many 401(k) plans also allow for employers to match their employee contributions. For example, an employer might match 50 cents for every $1 the employee contributes up to a certain percentage of salary. If this is an option for Ana, she should try to contribute at least enough money to take advantage of the full employer match. Some 401(k)s also allow for contributions to be split into a traditional 401(k) and some into a Roth 401(k). Again, if this is an option for Ana, she can utilize the Roth contributions to manage some of her tax burden. Further the earnings in a 401(k) are tax deferred for traditional 401(k)s and tax free in the case of a Roth 401(k). When Ana is ready to make a withdraw from a traditional 401(k), the money will be taxed as ordinary income. The Roth 401(k) money is already taxed as ordinary income so Ana will owe no tax on the withdraws as long as they meet the withdraw requirements (Kagan, 2019). Typically, 401(k) plans have a few different types of fees. Investment fees, administrative fees, and fiduciary fees. It is critical to discuss further with Ana these fees and consider how this affects her holistic plan. The average rage for 401(k) fees typical cost between 1% and 2% of the plan assets, however some plans can see fees as high as 3.5%. While there are many factors that can impact the cost of the plan asking Ana to provide her 408(b)2 fee disclosure, will help determine what course of action Ana should take when saving into this type of investment vehicle. Any unused funds left in the 401(k) can be passed onto a named beneficiary, in Ana’s case we are assuming her one-year old son.

Similarly, to 401(k)s, Ana should consider saving for retirement into an Individual Retirement Account (IRA). An IRA is an account that allows individuals to save for retirement with tax free growth or tax deferred basis. Ana could consider making contributions into a Traditional IRA, or a Roth IRA. Saving into a traditional IRA, Ana could make contributions that she may be able to deduct on her tax return, and any earnings could potentially grow tax deferred until she needs to withdraw them in retirement. Many people in retirement find that they are in a lower tax bracket than they were in pre-retirement, so the tax deferral means that the funds withdrawn may be taxed at a lower rate. Ana could also consider saving into a Roth IRA by making contributions with money that she has already paid taxes on. This would allow the funds to potentially grow tax free and she could withdraw the funds in retirement tax free, provided she meets all of the requirements. Financial professionals expect that approximately 85% of pre-retirement income will be needed in retirement. This means an employer sponsored plan, such as a 401(k), might not be enough to accumulate the savings Ana needs. Saving into an IRA in addition to 401(k) will supplement the retirement savings and also allows for a potentially wider range of investment choices than a 401(k), allowing for Ana to further diversify her savings. As far as costs go an IRA is a good option to consider as most IRAs cost very little in terms of fees. Many individuals open a traditional or Roth IRA and invest in a fund that costs very little or in some cases nothing. For example, the Fidelity ZERO Total Market Index Fund (FZROX), has 0% expense ratio and no minimums to invest (Fidelity, n.d.). Similar to the 401(k), any unused funds left in the IRAs can be passed onto a named beneficiary, in Ana’s case we are assuming her one year old son (Fidelity, 2019).

Ana should also consider saving into a Health Savings Account (HSA), if she is enrolled into a high deductible health plan, as they have some important tax advantages. In retirement, a wide range of medical, dental, and mental health services can become quite expensive. Utilizing an HSA can help plan for the unexpected health expenses during retirement. While Ana can only contribute up to &7,000 per year currently, if she does not withdraw the funds until retirement it can have a serious impact on her retirement lifestyle. Contributions are typically made with pre tax dollars and as a result are not included in gross income and not subject to federal income tax. Additionally, in most states’ contributions are not subject to state income tax either. If Ana makes contributions with after tax dollars, she could deduct them from her gross income on her annual tax return, thus reducing her tax burden for the year. When it is time to make withdraws in retirement from the HSA, they are not subject to federal/state taxes if used for qualified medical expenses. Further, any interest or earnings on the funds in the account are tax free. Finally, some HSAs charge a maintenance fee or transaction fee. These fees are not usually very high, but they should be considered as they eat into the bottom line (Folger, 2019).

While annuities may be good option for an income stream that will last a lifetime, there are many factors that need to be considered such as the complexity of the product, fees, surrender charges, and complicated rules that may limit access to the guarantees. A variable annuity is part investment product and part insurance product. Funds are put into mutual fund like accounts, and gains are tax deferred until withdraws are made. Withdraws are taxed as ordinary income rather than at lower capital gains tax rates, just like withdraws from traditional IRAs. The factor that Ana would be attracted to is the income guarantees that the product offers. The cost of the guarantees is variable from insurer to insurer but typically ranges from 1%-1.5% of the investment amount. Further, how the guarantees operate also vary by insurer. However, in general the insurer promises that the investor can withdraw a specific amount of money each year for the rest of the investor’s life, even if the investment selection chosen looses value or runs out of money. All of the benefits considered, some variable annuities come with high fees. For example, basic annuity fees (mortality and expense fees) can run 1.2% or more per year. Additionally, investors could pay more than 1% in investment fees for the underlying funds. If the investor wants to cash out the annuity, they could face surrender charges which can begin at 10% and decrease over the first decade of the annuity’s life. If Ana were to consider a variable annuity as part of her holistic retirement income plan, she should consider a variable annuity with lower fees such as one Vanguard sells that costs .75% or less per year plus a 1.2% fee if the income guarantee is added. The guarantee locks in the value of the investments on the anniversary of the annuity annually and bumps up the benefit if the value of the investments has gone up. Ana would be able to take 5% of the benefit base every year for the rest of her life if she started taking withdraws at age 60. Similar low expense products from TD Ameritrade, Ameritas, and Jefferson National are also offered (Lakeford, 2016).

Finally, Ana should consider purchasing life and disability insurance to protect her and her dependents should something happen to her. The big question for Ana regarding insurance, is what kind of insurance to purchase. Term life insurance is a policy when you pay your premium, and the death benefit goes to the beneficiaries of the policy in the event of death. Term policies are more affordable compared to their life insurance peers, normally costing $30-$40 per month for a 30-year $500,000 policy for healthy individuals in their 20s and 30s. The policy then expires or needs to be renewed at the end of the term. Whole life insurance has a death benefit but also a cash value. Every month, a portion of the premium goes into a tax deferred savings account called the cash value. However, due to the extra benefits a whole life policy can cost significantly more than a term life policy for the same death benefit. Permanent life insurance is a policy that lasts for as long as the premiums are paid and have a cash value component. Whole life insurance is a type of permanent life, so it has many of the same advantages and disadvantages that were previously discussed. Universal life insurance, like whole life insurance, has a cash value. The premiums are applied toward both the cash value and the death benefit. However, policyholders of universal life are able to change the premium and death benefit amounts without needing a new policy. For Ana, as her financial situation changes a universal life policy would allow her to change the death benefit amount (Lalley, 2019).

While there are other types of live insurance policies such as variable universal life, simplified issue life, guaranteed issue life, final expense insurance, group life insurance, etc., Ana’s situation makes the types discussed the most suitable for her holistic planning goals.

Disability insurance pays a portion of your income if you become unable to work for an extended period of time due to an illness or injury. While Ana may feel that the chance of missing months or years of work due to injury or illness is unlikely, especially because she is healthy and young, according to the social security administration more than 1 in 4 20 year old’s will experience a disability for 90 days or more before age 67 (Marquand, 2017) Since Ana stated that she wants to protect her and her dependents should something happen to her, a disability policy could help ensure that she has plenty of money to pay her bills should something happen in the future. The two main types of disability insurance are short term and long term coverage. Both replace a portion of your income during disability. Additionally, as Ana progresses through life, a long term care insurance policy could be considered for her down the road. Long term care is one way to prepare for costs associated with chronic medical conditions such as nursing home costs, in home care costs, adult day care centers, etc. For Ana, considering long term care in 24 years or so would be beneficial because if she waits until she needs care to buy coverage, it may not be an option. Qualifying for long term care insurance if you already have a pre-existing condition is difficult. Most people with long term care insurance purchase it when they are in the 50s (Marquand, 2019).

In order for Ana to be successful in achieving her target retirement lifestyle, she will need to thoughtfully consider a budgeting and savings strategy. Since Ana has stated that she wants to retire and have at least $100,000 of income annually, we need to determine how much she will need to have saved for retirement. Many financial advisors educate their clients that a sustainable withdrawal rate for retirement assets is 4%. The 4% withdraw rate is the amount that Ana could theoretically withdraw through ups and downs and still expect the portfolio to last at least 30 years (Folger, 2019). While this is not a hard-set rule, it is a good general guideline. To figure out how much she needs to have saved before retiring, we can use the $100,000 per year income and divide by the 4% withdraw rate to get how much, in today’s dollars, she will need saved not including social security, or pension benefits ($100,000 ÷ 0.04 = $2,500,000). Net present value calculations can help Ana determine how much she needs to invest each month to achieve her goal. For example, in order to save $2,500,000 to retire in 34 years, assuming an annual return of 10% she must save $8,760 per year; FV=PV×(1+i)^n (where FV=Future value of money PV=Present value of money i=Interest rate n=Number of compounding periods per year) (Myers, 2019). Many people use a financial calculator to solve TVM questions and in this case, we have four of the five components known, and a financial calculator can easily determine the missing factor. There are a couple reasons to support this savings goal in relation to Time Value Money theory. First, the funds can be invested and earn interest over time, giving it potential earning power, the money is also subject to inflation, eating away at the spending power of the money over time, making it worth a lesser amount in the future. The calculation is a good way for long term planning and budgeting.

In addition to the non-qualified assets that Ann can invest in order to achieve her financial goals and dreams, Ana’s should earmark funds that she earns from employment to ‘maxing out’ her annual IRA contributions. As of 2019 the maximum Ana can contribute to her IRAs is $6,000/year assuming she has earned income. Further she should plan on taking advantage of catch up contributions when she reaches the appropriate age, as an extra $1000 per year contribution can greatly impact the probability of success in reaching her retirement goal. In addition to saving into an IRA, Ana should add to her budget saving at least $2,760 annually into a workplace savings plan such as a 401(k) if she is eligible. If her employer offers a contribution match, Ana should take advantage of this program and contribute as much as possible to fully take advantage of the match. Once the 401(k) contributions have been maximized, making IRA contributions will help supplement the 401(k) savings and ensure she meets her retirement goal. Further Ana could consider earmarking funds in her budget to purchase a guaranteed income annuity. This strategy can be used to create her own pension of sorts. Adding a deferred income annuity that is paid into overtime could help Ana manage her current cash flow. This portion of the retirement plan can be implemented later in life or now depending on how Ana would like to implement the plan. Since she can buy a Guaranteed income annuity on an after tax basis, or within an Individual Retirement Plan (IRA), further conversations regarding if she prefers owing tax on the earnings or an upfront tax deduction with the entire annuity being taxable during withdraws to minimize her tax burden would need to be held (Whelehan, 2019). However, saving into this type investment vehicle and earmarking the funds for retirement will further ensure that Ana achieves her retirement savings goals.

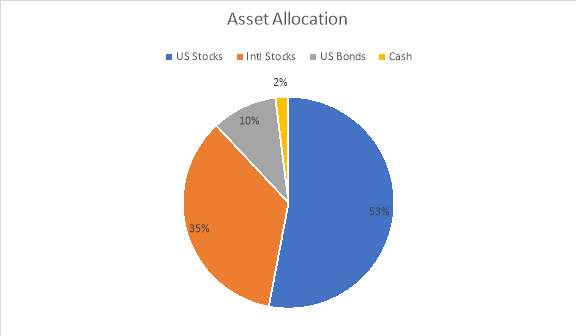

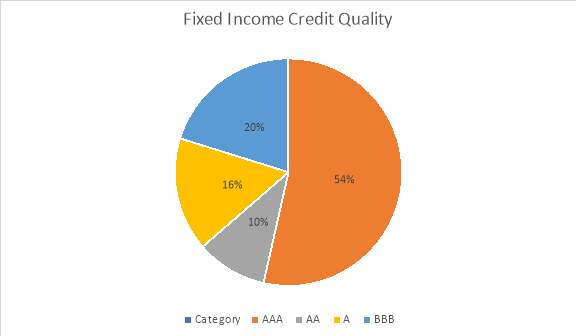

Based on the above analysis, Ana should utilize saving into a workplace retirement plan such as a 401(k) and supplement that savings with an additional savings into an IRA, both can be invested aggressively using either a mutual fund (possibly a target date fund) or an index ETF that match her risk tolerance and further diversify her holistic financial positions. Specifically, I would recommend an asset allocation of 53% US Equity, 35% Non-US Equity, 10% Fixed Income, and 2% Cash for funds earmarked for retirement with a 30+ year time horizon.

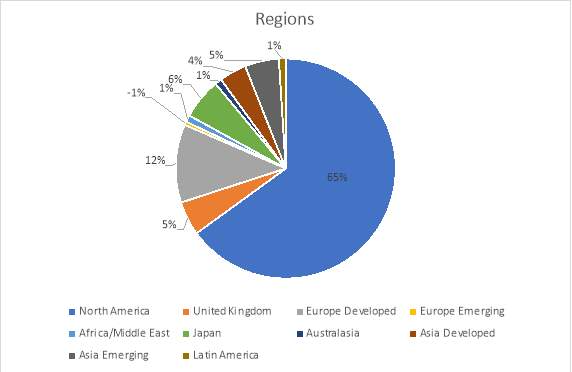

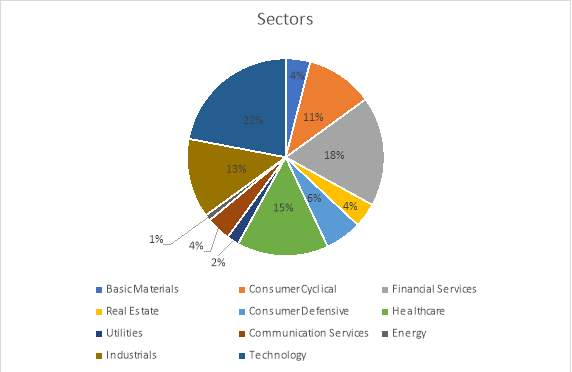

Within this asset allocation, funds should be diversified in terms of region and sector. Ideally, the equity holdings should be diversified in various sectors and regions using the following guidelines.

Even though diversification and asset allocation help improve returns, when considering the recommended portfolio, it is important to consider alpha and beta to quantify value and risk. Alpha measures the performance of the portfolio and in this particular case compares it to the Vanguard 500 Index. The difference between the returns of the proposed portfolio and the benchmark is called alpha. For Ana specifically the -2.18 annualized alpha indicates that the portfolio underperforms the S&P 500 benchmark. This can be justified because her portfolio includes fixed income and a small cash position which is not included in the benchmark. Ideally Ana should be using a benchmark that is more closely aligned with her goals and portfolio instead of the S&P 500. Beta measures the volatility of the portfolio in comparison to the benchmark index. Unlike the alpha, beta illustrates the movements in the asset prices. In the proposed portfolio the Beta is 0.90 which indicates that the portfolio is less volatile. For Ana specifically, it is recommended that she avoid high alpha and beta investments as taking on too much risk is counterproductive and unnecessary as her holistic financial plan will include other assets that can be used during retirement such as her non-qualified assets. When considering the returns, the average annualized returns of the proposed portfolio from 2011 to 2019 is 9.32%. This return is consistent with the yield needed in retirement assets and supplementing these accounts with both her non-qualified funds and income from a guaranteed annuity to achieve her goals.

In addition to these IRA/401(k) portfolio holdings, Ana should purchase Life Insurance as well as Disability insurance to protect her nest egg as well as future assets such as a home. Additionally, these policies ensure that she and her child are taken care of financially should something happen to her.

Overall, Ana should plan on contributing to her employer retirement plan and take advantage of any employer match that is offered. Once she reaches the maximum 401(k) contributions up to the maximum match, she should begin contributing the annual maximum to an IRA in order to supplement the 401(k) savings. Finally, adding in a guaranteed income annuity to her holistic retirement planning will ensure that Ana can retire comfortably knowing that she will sees the annual income that she stated that she will need during retirement years. Finally, it is recommended that Ana purchase both Life and Disability insurance so that she can feel confident knowing that there will be funds to provide for her and her son, Robert, should something happen to her.

It is evident that planning for retirement should be a lifelong process and the sooner it can begin, the easier it is to achieve the financial goals. Throughout Ana’s working years, her retirement plan will likely move through a series of different stages. As she moves through these stages, she will want to continue to evaluate the progress made, and her targets to make educated decisions to ensure she achieves her goal. How much money she will actually need in retirement is difficult to know and hard to plan but being over prepared by starting to save earlier rather than later is always the best decision.

References:

- Fidelity Investments. (n.d.). No minimum investment mutual funds. Retrieved November 22, 2019, from https://www.fidelity.com/mutual-funds/investing-ideas/index-funds.

- Fidelity Investments. (2019). What Is An IRA? Retrieved November 22, 2019, from https://www.fidelity.com/building-savings/learn-about-iras/what-is-an-ira.

- Folger, J. (2019, November 20). Health Savings Accounts: Advantages and Disadvantages. Retrieved November 22, 2019, from https://www.investopedia.com/articles/personal-finance/090814/pros-and-cons-health-savings-account-hsa.asp.

- Folger, J. (2019, November 18). Will Your Retirement Income Be Enough? Retrieved November 22, 2019, from https://www.investopedia.com/retirement/retirement-income-planning/.

- Kagan, J. (2019, November 21). What is a 401(k) Plan? Retrieved November 22, 2019, from https://www.investopedia.com/terms/1/401kplan.asp.

- Lalley, C. (2019, August 27). Different Types of Life Insurance Policies, Explained. Retrieved November 22, 2019, from https://www.policygenius.com/life-insurance/types-of-life-insurance/.

- Lankford, K. (2016, April 1). Variable Annuities: Guaranteed Income, With a Catch. Retrieved November 22, 2019, from https://www.kiplinger.com/article/retirement/T003-C000-S002-variable-annuities-guaranteed-income-with-a-catch.html.

- Marquand, B. (2017, October 20). Disability Insurance: Why You Need It and How to Get It. Retrieved November 22, 2019, from https://www.nerdwallet.com/blog/insurance/disability-insurance-explained/.

- Marquand, B. (2019, May 28). Long-Term Care Insurance Explained. Retrieved November 22, 2019, from https://www.nerdwallet.com/blog/insurance/long-term-care-insurance/.

- Myers, D. (2019, November 18). Determine What Things Will Be Worth via the Time Value Of Money. Retrieved November 22, 2019, from https://www.investopedia.com/articles/fundamental-analysis/09/net-present-value.asp.

- Whelehan, B. (2019, October 21). 10 Best Retirement Plans In 2019. Retrieved November 22, 2019, from https://www.bankrate.com/retirement/best-retirement-plans/.