"History shows that states should restrict their monetary policy only to the purpose of creating a stable currency"

1. Introduction

Historically government and financial authorities have carried out many measures and policy to control and stabilize their interest rate. Monetary policy is one of these measures adopted by government to stabilize its currency price. Monetary policy is referred to the policy adopted by country authority to control its interest rate and it is aimed to be effective to manage inflation and interest rate so that price can be stable and currency trust can be built up. Generally monetary policy is to manage money supply and control a country’s interest rate through the central bank to make sure the price is stable. However not all people agree that government should restrict their monetary policy because it has many drawbacks. It is the writer’s stance that the advantage of monetary policy overweighs its disadvantages. A country should restrict monetary policy to contribute to its currency stabilization.

2. Stabilize currency

Monetary policy can increase investors’ confidence in investment and consumption because the currency is stable. Furthermore, monetary policy is usually accompanied with the low interest rate on loans and mortgages. Business are encouraged and welcomed to expand their business and borrow money from banks since there are available and low interest rate funding for them. Business can afford their loans. Furthermore, currency stability usually means the constant return of investment. Thus, consumers are more willing to purchase consumers good. This will contribute to the company’s profitability, as they are able to afford the basic property, service and commodities (Benchimol, 2012). Furthermore the lower interest rate can benefit the home buyers to meet the demand of their homes. When the mortgage fee is reduced, it will give home owners more money to spend in the other commodities. It can be seen that restricting monetary policy can improve and increase economy. Apparently, this is a win-win outcome for property investors, creditors and merchandisers.

3. Contribute to global economy stabilization

Besides the advantage of currency stabilization, monetary policy can create more money which enables to purchase the bonds from the bank. Furthermore supporters of monetary policy say that when it comes to the monetary policy. Restricting monetary policy contribute to the stable global economy because currency is the only exchange of their goods traded in value against others. Currently there is no global standard currency, however the monetary policy tool contributes to the financial market consistency. This is the reason why a country such as USA will produce more money to devalue their currency (Jahan, 2018). In the era of globalization, the stabilization of a country’s currency can contribute to the stabilization of other countries.

3. Promote transparency and low interest rate

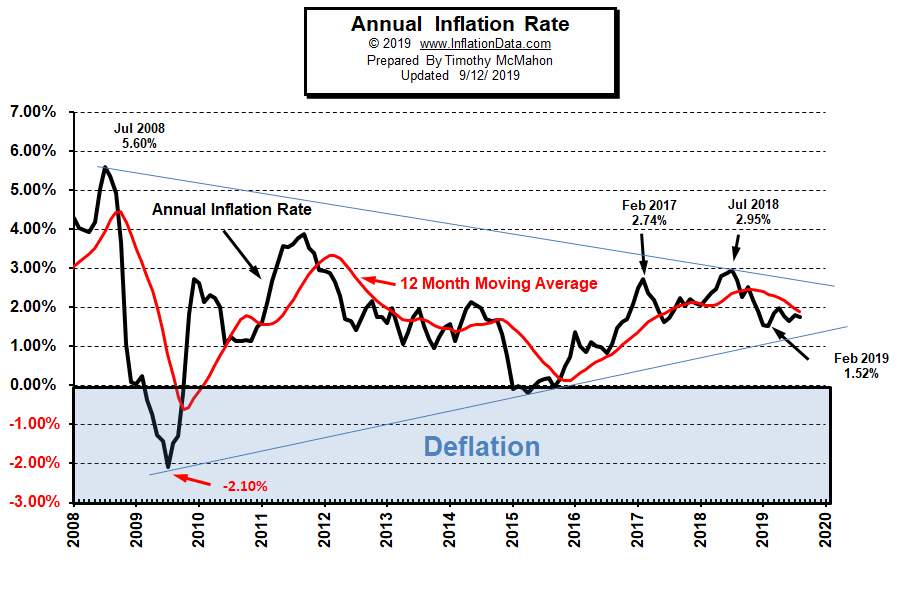

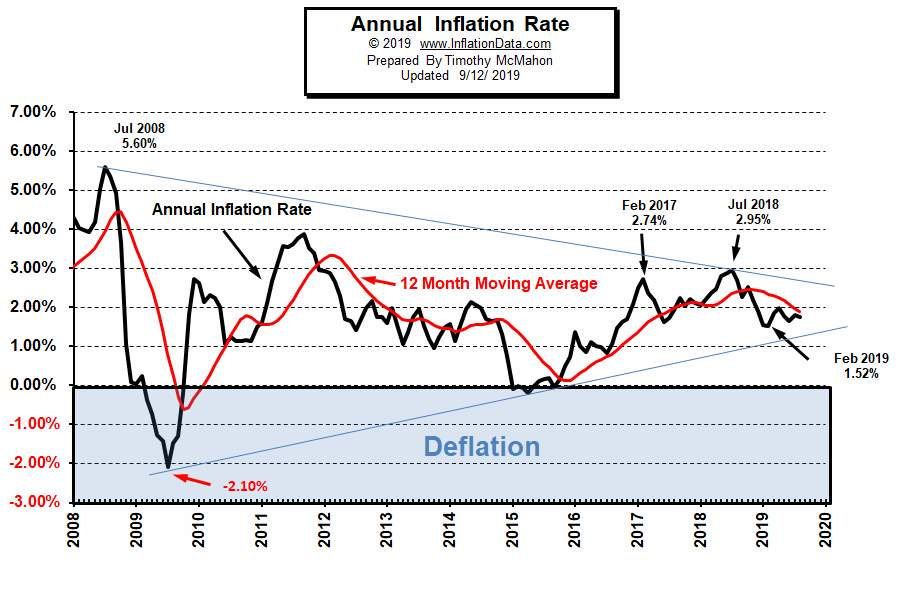

Monetary policy can make sure the financial result is predictable because people and companies in the organization understand and know what movement they need to do in order to succeed. For example, they know what they need to do and understand public ability. Therefore, consumers and organizations are allowed to make decision about their future instead of using other tools to measure the financial trends. Transparency can reduce the problem emerging in the global trading. Monetary policy can also reduce the inflation rate in a country as a result of price stability (Corsetti, 2005). This is obvious and apparent that when consumers know how much of their goods will cost, they will like to initiate a transaction. Since the value of a good is constant and consistent. For example, the following figure shows that the inflation rate of USA is stable and it is just 10%. This means that the 10 dollars in 2009 was 10.9 dollars in 2018.

Source from https://inflationdata.com/Inflation/Inflation_Rate/CurrentInflation.asp

4. Problems of monetary policy

Even though monetary policy is overall good for a country while its negative impacts should not be overlooked. Monetary policy does not guarantee economy growth. People and business have free will to make decision what they need to do. When the interest rate is lower, they can choose to initiate the expense. In addition, monetary policy can give everyone the same chance to success, while it also hampers the benefits of some people. Furthermore it also contributes to the high risk of hyperinflation (Gopinath, 2008). If everyone is purchasing the house, it will lead to the house bubble possibly.

5. Conclusion

In conclusion, this essay discusses the statement about the monetary policy which has both pros and cons. Monetary policy is good for a country to stabilize a price of currency and it can reduce interest rate, so that people can boost economy growth. People and investors are more willing to invest. Monetary policy is also good for the global economy stabilization. However the problems of monetary policy should not be overlooked, it has some problems.

References

- Benchimol, J., Fourçans, A. (2012), Money and risk in a DSGE framework: A Bayesian application to the Eurozone, Journal of Macroeconomics, vol. 34, pp. 95–111.

- Corsetti, G., Pesenti, P. (2005). International dimensions of optimal monetary policy. Journal of Monetary Economics, 52(2), pp. 281–305

- Gopinath, Gita; Rigobon, Roberto (2008). "Sticky Borders". Quarterly Journal of Economics. 123 (2): 531–575.

- Jahan, Sarwat. "Inflation Targeting: Holding the Line". International Monetary Funds, Finance & Development.